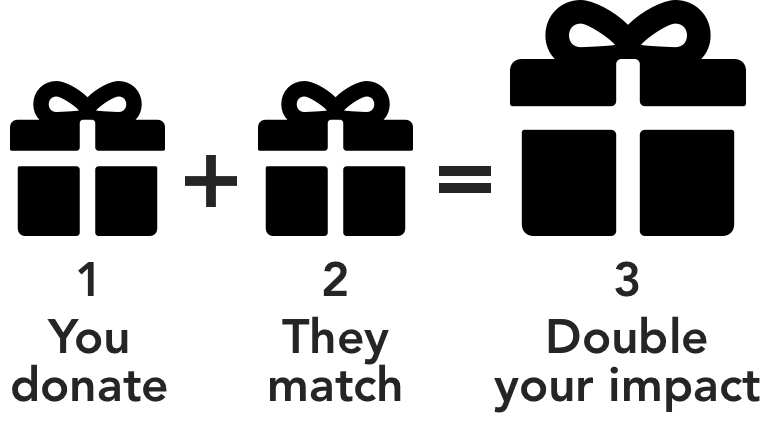

Get your donation matched by your employer and DOUBLE YOUR IMPACT!

Wouldn’t you want to DOUBLE your gift to OLG without any additional cost to you?

YOU MAY BE ELIGIBLE TO DO IT!

How? Through a Matching Gifts Program offered by your employer!

What are matching gifts or matching donations?

Matching gifts are the most-offered workplace giving program, loved by employers and donors alike! In fact, more than 65% of Fortune 500 companies incorporate matching gifts in their business practices, not to mention thousands of smaller and mid-sized companies. Even better, according to the most recent statistics, more than 26 million individuals are employed by companies that offer matching gift programs. And that figure is constantly rising! YOU might be one of those people and you just don’t know it yet.

How do matching gifts work?

The matching gifts process is simple and requires little effort on the part of the donor (you). Here’s how it works:

- You complete your donation to OLG.

- Follow the instructions provided by your HR department on how to submit a matching gift request (it usually takes minutes, and it is a quick online or paper form)

- Your employer reviews the request to ensure that it meets their matching gift guidelines.

- Your employer reaches out to OLG to confirm the donation.

- Your employer sends a check to OLG to complete MATCHING YOUR DONATION!

That’s it! This is how you get to give “40 for 20” without any additional cost to you! And because this process requires no other action on your part other than submitting your matching gift request to your employer, it’s incredibly easy to do but the impact is HUGE.

How can you find out if your employer offers matching gifts?

There are a few ways you can find out:

- Your employer’s company website should have a form employees fill out to apply for a matching donation (also called a matching gift). If you do not find one on the company website, a human resource representative at your company should be able to provide you with one.

- Approach your HR department and ask if they have a “gift matching” or “donation matching” program.

- Check out our most updated list of companies with a Gift Matching Program. Please keep in mind that this is not a comprehensive list and if your employer is not listed here, that does NOT MEAN they don’t offer a Gift Matching program. Please make sure you ask your HR department.

- Use any of the tools available online that lets you search for your employer’s matching gift guidelines. Here is one quick option:

-

- https://www.charitynavigator.org/donor-basics/giving-101/employee-match-programs/ (scroll down to find the search tool)

Will you need any other specific information besides the name of our school?

Please see below some school details you may need when completing a Matching Gift request:

- Name of the organization: Our Lady of Guadalupe Catholic School

- Tax exemption number (or EIN number): 91-0725901

- Contact person within the organization: Natalie Trius, Director of Development

- Email: development@guadalupe-school.org

- Address: 3401 SW Myrtle St. Seattle, WA 98126

- Phone number: 206-935-0651

- Website: https://www.guadalupe-school.org/

After You Have Submitted the Matching Donation Form: You should receive some type of confirmation from your company on whether your request for a matching donation was approved. This could be in the form of a letter or email your company generates and sends to you.

Easy, don’t you think? Doesn’t this make you want to donate and see your gift DOUBLE?

For additional information, please check out this Matching Gift Guide to learn the other ways your employer may offer “Gift Matching.”